Homeowners Insurance in and around Middletown

Looking for homeowners insurance in Middletown?

Help cover your home

Would you like to create a personalized homeowners quote?

What's More Important Than A Secure Home?

With your home covered by State Farm, you never have to worry. We can help you make sure that in the event of damage from the unpredictable burglary or falling tree, you have the coverage you need.

Looking for homeowners insurance in Middletown?

Help cover your home

Protect Your Home With Insurance From State Farm

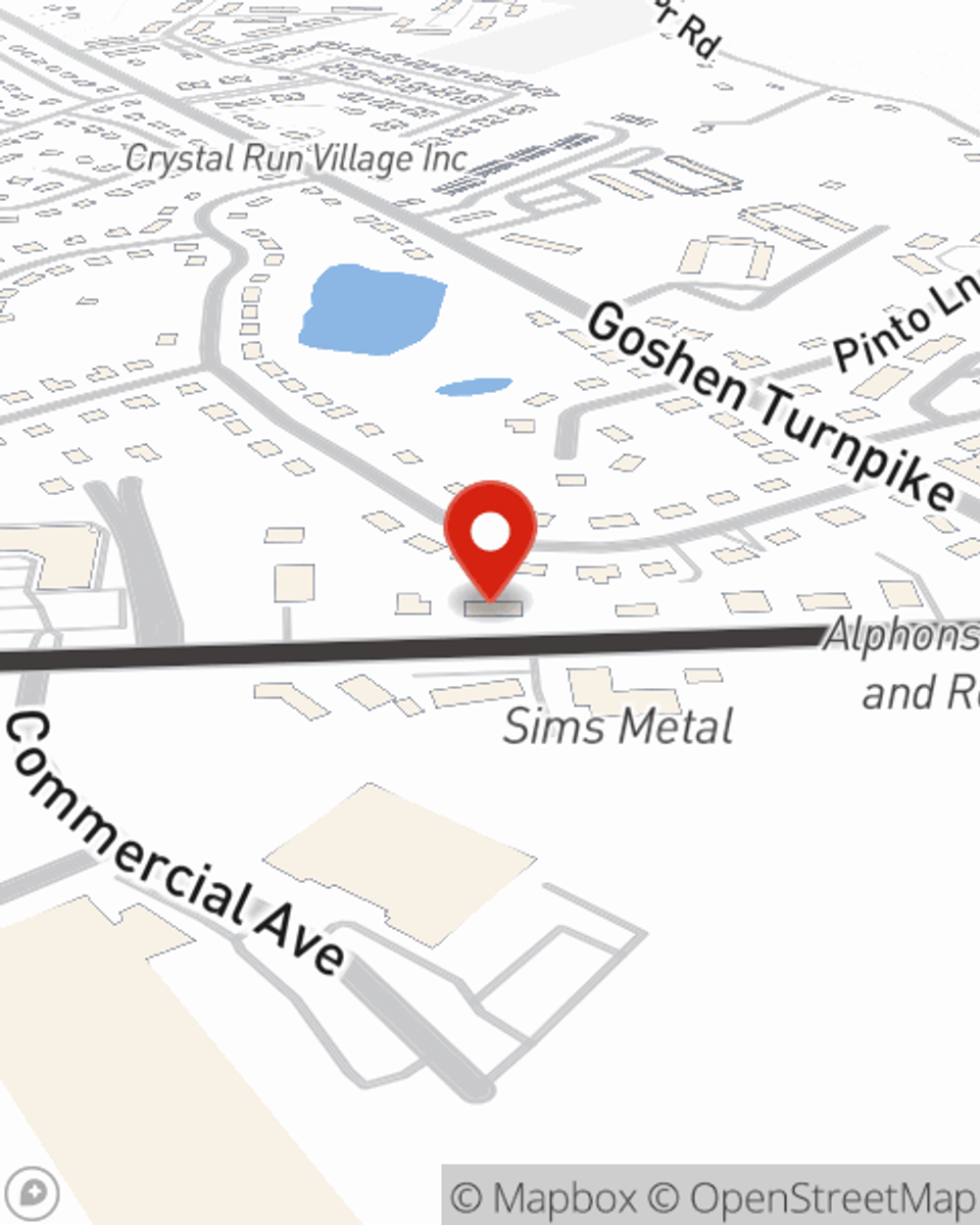

State Farm Agent De Anne Gleeson is ready to help you handle the unexpected with excellent coverage for your home insurance needs. Such personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, De Anne Gleeson can help you submit your claim. Find your home sweet home with State Farm!

As your good neighbor, State Farm agent De Anne Gleeson is happy to help you with getting started on a homeowners insurance policy. Call or email today!

Have More Questions About Homeowners Insurance?

Call De Anne at (845) 692-3456 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Protecting your home while on vacation

Protecting your home while on vacation

Home security while on vacation is important. Consider these tips before you head out.

What to do after a wildfire

What to do after a wildfire

The aftermath of a wildfire can feel overwhelming. When you get the all-clear to return home, know where to start and how to stay safe as you recover.

De Anne Gleeson

State Farm® Insurance AgentSimple Insights®

Protecting your home while on vacation

Protecting your home while on vacation

Home security while on vacation is important. Consider these tips before you head out.

What to do after a wildfire

What to do after a wildfire

The aftermath of a wildfire can feel overwhelming. When you get the all-clear to return home, know where to start and how to stay safe as you recover.